Safety Harbor Business Tax Receipt . Under section 14.01 of the city code requires all businesses within the city of safety harbor to obtain a business tax receipt prior to. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. Local business tax application procedures. Any person engaging in or managing any business, occupation, or profession in the city of safety.

from www.johnhelldorfercpa.com

Local business tax application procedures. Any person engaging in or managing any business, occupation, or profession in the city of safety. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. Under section 14.01 of the city code requires all businesses within the city of safety harbor to obtain a business tax receipt prior to. Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic.

IRS Provides Gross Receipts Safe Harbor for Employers Claiming ERC

Safety Harbor Business Tax Receipt Under section 14.01 of the city code requires all businesses within the city of safety harbor to obtain a business tax receipt prior to. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. Any person engaging in or managing any business, occupation, or profession in the city of safety. Under section 14.01 of the city code requires all businesses within the city of safety harbor to obtain a business tax receipt prior to. Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. Local business tax application procedures.

From www.youtube.com

10 Strategies To Reduce Your Taxes! 1 IRS Safe Harbor Rule YouTube Safety Harbor Business Tax Receipt Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. Local business tax application procedures. Under section 14.01 of the city code requires all businesses within the city of safety harbor to obtain a business tax receipt prior to. Any person engaging in or managing any business, occupation, or profession in. Safety Harbor Business Tax Receipt.

From www.robertprussocpa.com

Gross Receipts Safe Harbor for Employers Claiming ERC Safety Harbor Business Tax Receipt Under section 14.01 of the city code requires all businesses within the city of safety harbor to obtain a business tax receipt prior to. Any person engaging in or managing any business, occupation, or profession in the city of safety. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. The. Safety Harbor Business Tax Receipt.

From governmenterc.com

IRS Provides a Safe Harbor for the Employee Retention Credit Gross Safety Harbor Business Tax Receipt Any person engaging in or managing any business, occupation, or profession in the city of safety. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. Local business tax application procedures. The. Safety Harbor Business Tax Receipt.

From www.pinterest.com

10 Ways to Safe Harbor your finances during economic downturn Safety Harbor Business Tax Receipt Any person engaging in or managing any business, occupation, or profession in the city of safety. Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. The irs issued a safe harbor. Safety Harbor Business Tax Receipt.

From www.youtube.com

How to Apply for the Local Tax Receipt in MiamiDade, FLorida YouTube Safety Harbor Business Tax Receipt Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. Any person engaging in or managing any business, occupation, or profession in the city of safety. Local business tax application procedures. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. Under. Safety Harbor Business Tax Receipt.

From drive.google.com

HMP_FRM_Safe Harbor Attestation Form_2023_EN Google Drive Safety Harbor Business Tax Receipt The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. Any person engaging. Safety Harbor Business Tax Receipt.

From invoicehome.com

Free Receipt Templates Quickly Create & Send Receipts Safety Harbor Business Tax Receipt Any person engaging in or managing any business, occupation, or profession in the city of safety. Local business tax application procedures. Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. Under. Safety Harbor Business Tax Receipt.

From www.bayharborislands-fl.gov

BUSINESS TAX RECEIPTS Bay Harbor Islands, FL Safety Harbor Business Tax Receipt The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. Under section 14.01 of the city code requires all businesses within the city of safety harbor to obtain a business tax receipt. Safety Harbor Business Tax Receipt.

From www.pinterest.com

Word and excel documents to print security deposit receipts and other Safety Harbor Business Tax Receipt Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. Any person engaging in or managing any business, occupation, or profession in the city of safety. Under section 14.01 of the city. Safety Harbor Business Tax Receipt.

From safe-harbor-form.pdffiller.com

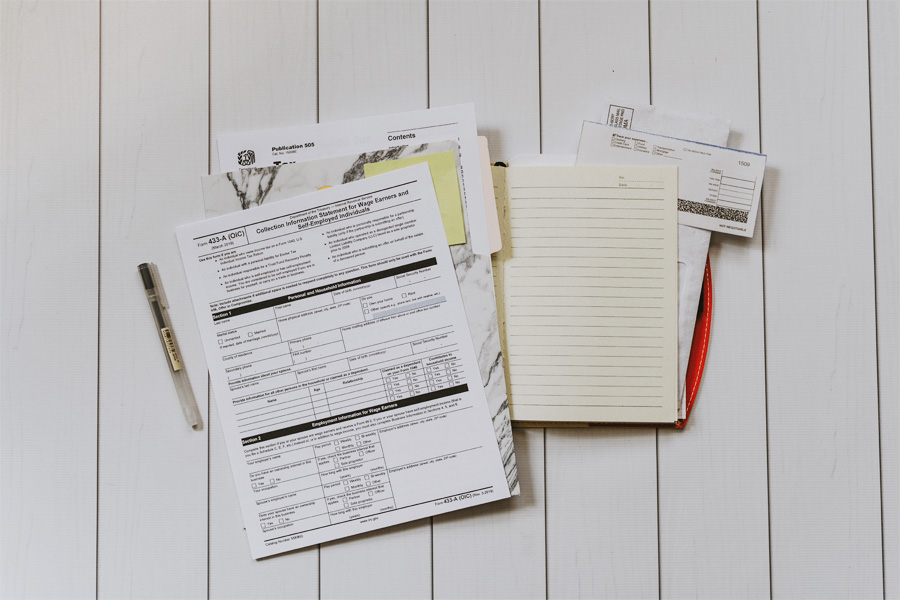

Safe Harbor Form Fill Online, Printable, Fillable, Blank pdfFiller Safety Harbor Business Tax Receipt The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. Any person engaging in or managing any business, occupation, or profession in the city of safety. The irs issued a safe harbor. Safety Harbor Business Tax Receipt.

From www.youtube.com

091 Using The Safe Harbor Method for Quarterly Estimated Tax Payments Safety Harbor Business Tax Receipt Under section 14.01 of the city code requires all businesses within the city of safety harbor to obtain a business tax receipt prior to. Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other. Safety Harbor Business Tax Receipt.

From www.safeharborpaymentsystems.com

Credit Surcharge SAFE HARBOR Safety Harbor Business Tax Receipt Local business tax application procedures. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. Under section 14.01 of the city code requires all businesses within the city of safety harbor to. Safety Harbor Business Tax Receipt.

From chaselawmb.com

Chase Law Group Safety Harbor Business Tax Receipt Under section 14.01 of the city code requires all businesses within the city of safety harbor to obtain a business tax receipt prior to. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a. Safety Harbor Business Tax Receipt.

From dennischincpa.com

Gross Receipts Safe Harbor Now Available for Employee Retention Credit Safety Harbor Business Tax Receipt The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. Under section 14.01 of the city code requires all businesses within the city of safety harbor to obtain a business tax receipt. Safety Harbor Business Tax Receipt.

From awmcap.com

Athlete Taxes Safe Harbor Strategy — AWM Capital Safety Harbor Business Tax Receipt Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. Under section 14.01 of the city code requires all businesses within the city of safety harbor to obtain a business tax receipt prior to. Any person engaging in or managing any business, occupation, or profession in the city of safety. The. Safety Harbor Business Tax Receipt.

From www.sec.gov

(SAFE HARBOR STATEMENT IMAGE) Safety Harbor Business Tax Receipt Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. Local business tax application procedures. Under section 14.01 of the city code requires all businesses within the city of safety harbor to obtain a business tax receipt prior to. The irs issued a safe harbor that allows an employer to exclude. Safety Harbor Business Tax Receipt.

From www.vrogue.co

30 Best Acknowledgement Receipt Templates Letters Vrogue Safety Harbor Business Tax Receipt Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic. Any person engaging in or managing any business, occupation, or profession in the city of safety. Under section 14.01 of the city. Safety Harbor Business Tax Receipt.

From proconnect.intuit.com

Solved Safe Harbor Election for Rentals (250 hour rule) Intuit Safety Harbor Business Tax Receipt Washington — the department of the treasury (treasury) and the internal revenue service (irs) today issued a safe harbor. Under section 14.01 of the city code requires all businesses within the city of safety harbor to obtain a business tax receipt prior to. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other. Safety Harbor Business Tax Receipt.